Yield+ is designed to build economic activity on EOS through incentivizing DeFi dApps that increase TVL and generate yield. This report is produced monthly and will develop organically as the granularity and significance of data evolves.

The program entered its third full month in November and the general theme since inception of the program is that a positive impact has been experienced, especially considering the volatile macroeconomic environment.

Total Value Locked (TVL)

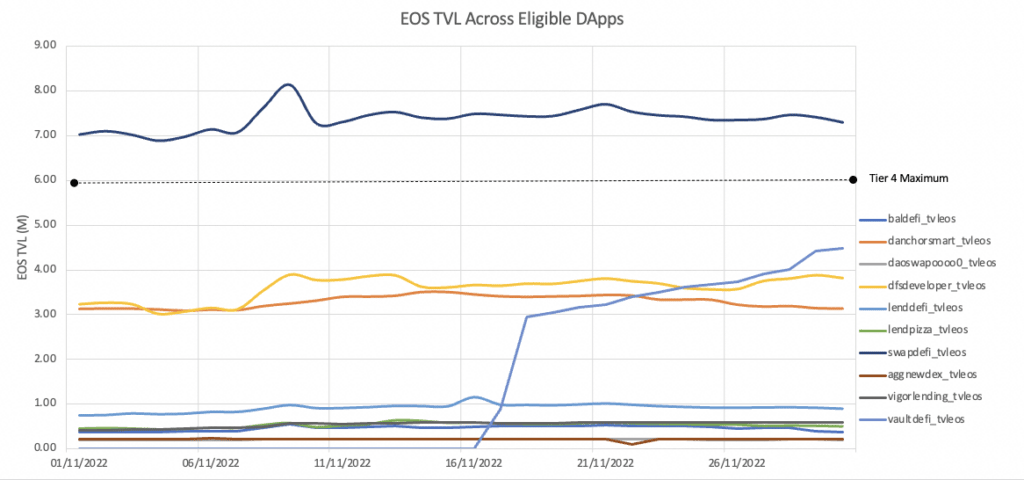

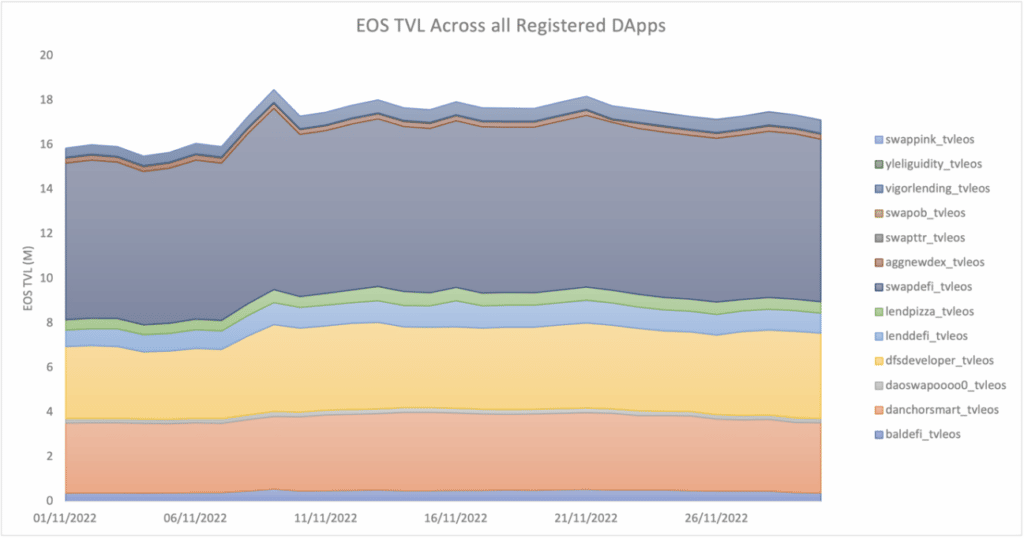

The current program allows for EOS and USDT to be counted as TVL for reward eligibility.

There are 4 tiers of eligibility for dApps with minimum TVL of EOS 200K, 750K, 1.5M and 3M respectively.

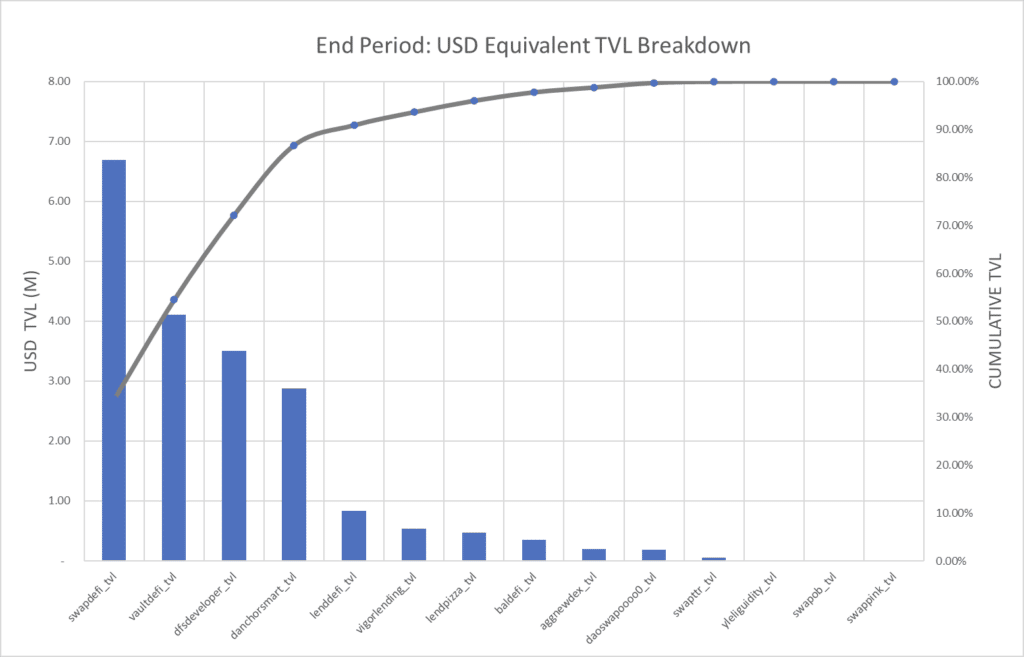

Fourteen dApps are now participating in the program with eight qualifying for rewards. Vault.defi, a new addition to the program, qualified for rewards with close to 4.5 million EOS in TVL

Yield+ Treasury Account

The Treasury received no further funding this month. With an uptick in rewards being paid out, funding should be planned for January at its latest with the account having just over 2 months of runway at current TVL and EOS price levels.

98% of rewards allocated this month were claimed with the residual from last month all claimed. The small amount of unclaimed rewards are owed to the same dApps as last month who were late to claim.

| Protocol | Unclaimed Rewards |

| bal.defi | 0 |

| danchorsmart | 0 |

| dfsdeveloper | 14 |

| lend.defi | 0 |

| lend.pizza | 912 |

| swap.defi | 0 |

| Vigorlending | 0 |

| daoswap | 949 |

| agg.newdex | 147 |

| Total | 2,030 |

The account balance was depleted and adjusted accordingly:

| Starting Balance + Funding | 259,861.5051 |

| Allocated | (83,469.2116) |

| Unclaimed | 2,030.1828 |

| End Balance | 176,737.3972 |

| Net of liabilities | 257,831.3223 |

Performance Metrics

The original Yield+ Blue Paper highlighted three core stages of the transition of a Layer 1 chain’s value proposition from speculation to ecosystem driven.

EOS remains in the first of these stages, ‘Green Field’, where Market Cap exists without significant TVL. In this stage, the Yield+ reward mechanism primarily aims to drive adoption through the TVL to Market Cap ratio, whilst the other factors are less significant.

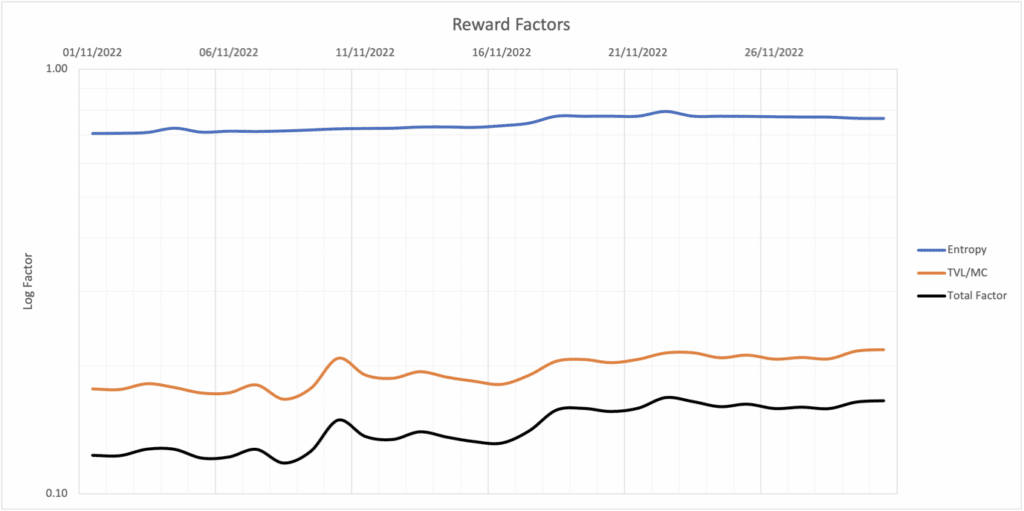

As a brief reminder, the paper considers a formula to calculate total rewards is calculated via three factors

- TVL to Market Cap ratio

- Absolute TVL (scaled [0.1])

- Distribution of TVL – Entropy (scaled [0.1])

The three different factors that will ultimately determine long term rewards play different roles in driving this progress.

The absolute TVL factor at this moment approximates as 1 so it is removed from the analysis.

- our Entropy factorhas remained steady between 0.72 and 0.76 suggesting a relatively healthy TVL breakdown. The slight trend has been back from the bottom of this range to the top, reversing last month’s changes.

- The Absolute TVL factor has had little effect remaining at close to 1 as it should only become relevant in the latter stages of the program.

- We have therefore seen an extremely high correlation of 0.987 between rewards paid out and TVL to Market Cap ratio. This positive correlation is as desired at this stage in the program.

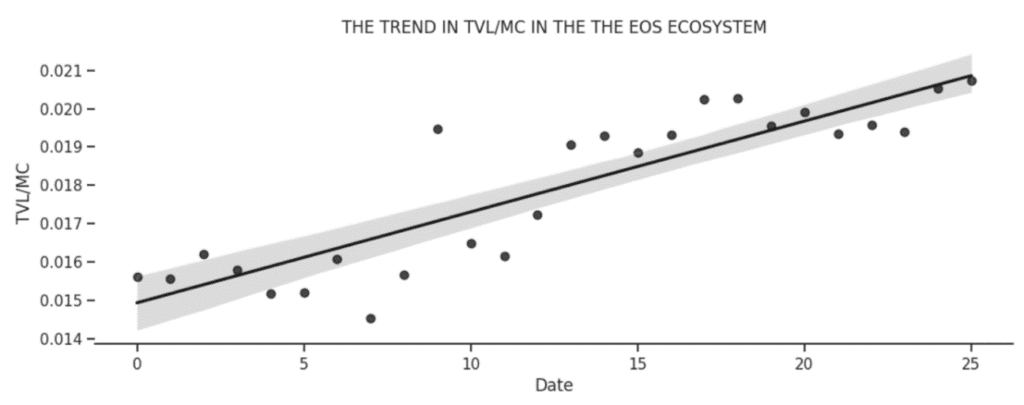

Although we have again seen a reduction in both TVL and Market Cap along with the broader crypto market, there has been a 9% growth trend in the key TVL to Market Cap ratio.

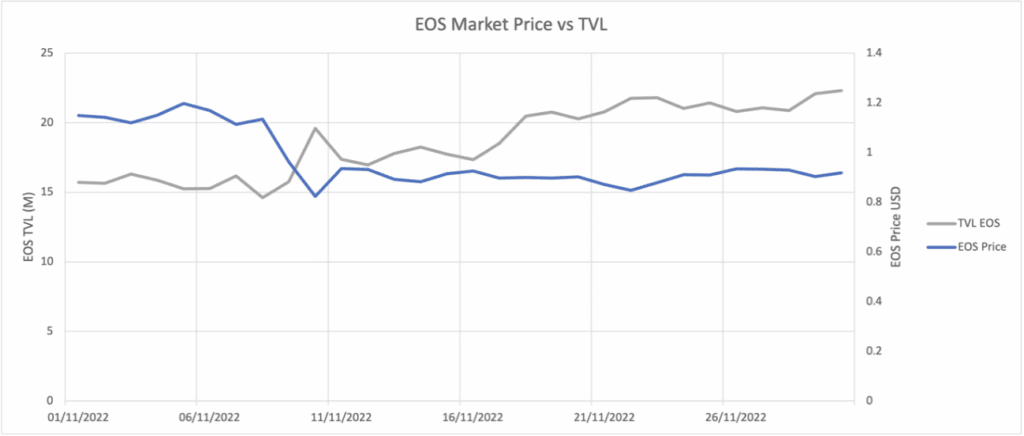

We continue to observe the correlation between the price of EOS and TVL in normal moments with market shocks still disruptive but decreasing in frequency.

The early resilience of the TVL metric through the first couple months of the program hints at the potential for speedier adoption in the ecosystem. Though modest, these are early signs that the program has received recognition and supports a positive outlook for the program.

Wider Market

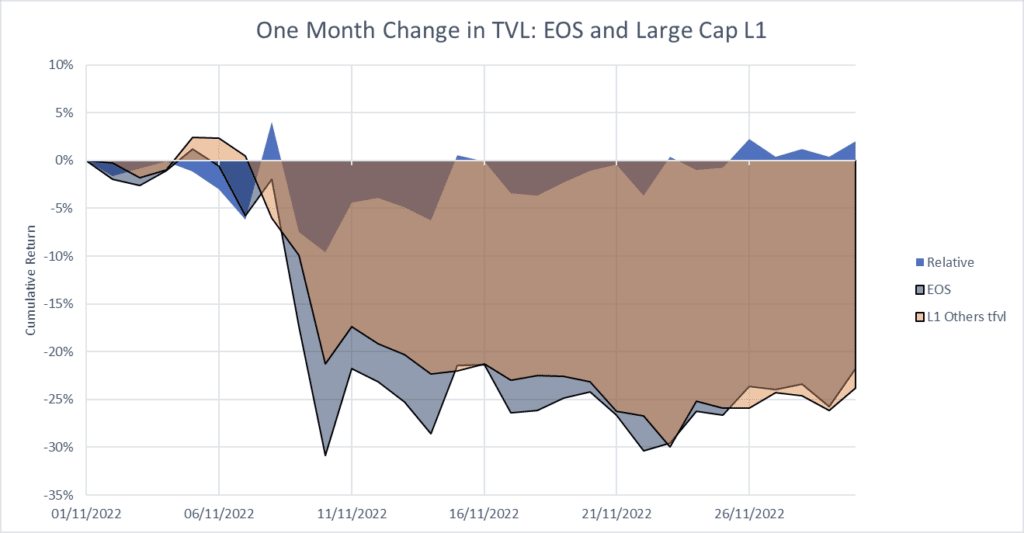

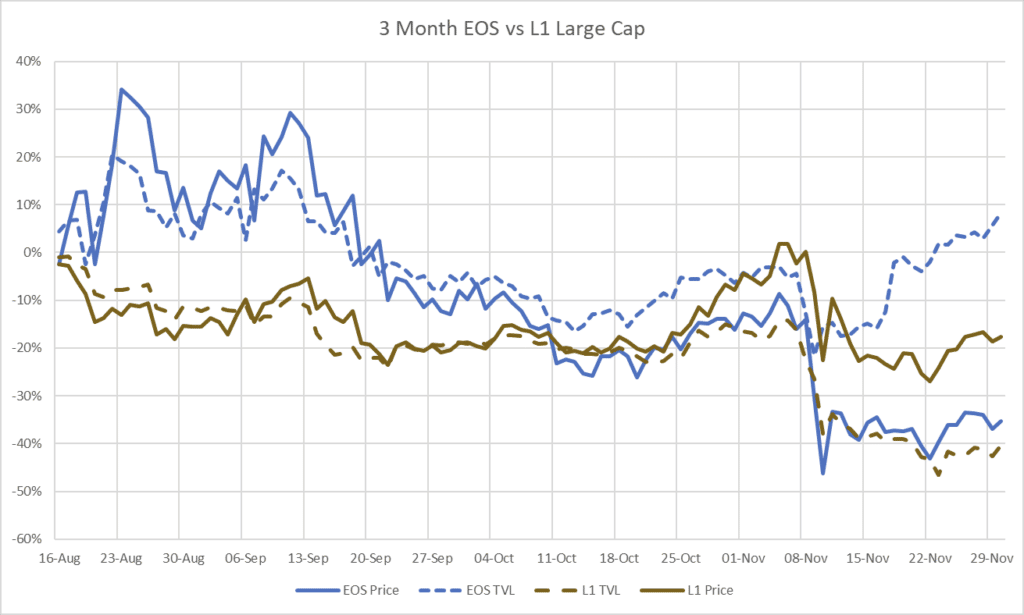

This month has seen another shock to value trends in defi. Below we have plotted TVL in EOS against TVL in six other large cap L1 chains. Although EOS still ranks outside the top 20 chains when it comes to absolute TVL, its specific TVL growth remains positively dislocated from the market.

Monthly comparisons

This next graph presents data from the totality of the period of the program. It seems to confirm what the more granular data suggests – EOS is still fighting its way into the second stage of TVL development and focus should remain on outreach and awareness. Whilst TVL in EOS has defied the market to show small amount of growth in total its price has been correlated with the wider market’s TVL. This suggests the price of EOS has not reached independence to be driven by its own ecosystem’s activity and is rather driven by wider crypto price activity.

The data this month confirms the same conclusions reached in previous reports and so recommendations remain similar. The program sees steady uptake and steady growth in TVL against market cap. TVL in the EOS ecosystem remains strongly idiosyncratic, although not entirely immune from trends in the wider market.

Recommendations

Since this is still early in the Yield+ program, the dataset does not allow us to draw hard and fast conclusions as to its effectiveness. However, there is not yet any real growth or expansion from new EOS DeFi protocols looking to tap into the implicit funding from Yield+. We can attribute this to the recent market shock from the FTX bankruptcy and the ongoing contagion on DeFi players.

However, with the market stabilising, we would expect to see new entrants to the EOS ecosystem qualifying for the program and this may well require greater promotion of the program to potential dApps.

In addition, as the program matures, and as the market volatility subsides, improvements should be made to the algorithm to shift from static to dynamic incentives that optimise the three-factor adoption thesis.

We reiterate our view that the accumulation of TVL on chain from a diversified selection of DeFi dApps will drive economic expansion of the Ecosystem and contribute to the capital value, security and catalytic growth of EOS.

Level-up your knowledge of Yield+ and get involved!

Explore the Yield+ Portal.

Join the Yield+ Channel on Discord.

Connect with Yield+ Support on Telegram.

Study the Yield+ Documentation.

Dive into the eosio.yield-contracts Github repo.

Read the Yield+ Blue Paper.

Read the Previous Yield+ Report

EOS Network

The EOS Network is a 3rd generation blockchain platform powered by the EOS VM, a low-latency, highly performant, and extensible WebAssembly engine for deterministic execution of near feeless transactions; purpose-built for enabling optimal web3 user and developer experiences. EOS is the flagship blockchain and financial center of the Antelope framework, serving as the driving force behind multi-chain collaboration and public goods funding for tools and infrastructure through the EOS Network Foundation (ENF).

EOS Network Foundation

The EOS Network Foundation (ENF) is a not-for-profit organization that coordinates financial and non-financial support to encourage the growth and development of the EOS Network. The ENF is the hub of the EOS Network, harnessing the power of decentralization as a force for positive global change to chart a coordinated future for EOS.