- Introduction

- Background

- Rationale

- FAQs

- 1. What is EOS Network Ventures?

- 2. Why launch the ENV as an independent entity? Couldn’t the ENF take on these same functions?

- 3. How was ENV initially funded, and what account currently holds the ENV tokens?

- 4. Who will be directing the ENV?

- 5. Who are the ENV’s decision makers?

- 6. What is the EOS Fund Management (EFM)? Who are the EFM multisig members, and why were they chosen?

- 7. Who are the General Partners (GP) and Limited Partners (LP) managing ENV?

- 8. What is the structure and operating model of the ENV and related bodies in the EOS ecosystem?

- 9. Where will the ENV be incorporated?

- 10. What was the communication with the community in planning this initiative?

- 11. What is the vision for how the ENV will impact the EOS community?

- 12. How will the ENV be held accountable to token holders?

- Additional Resources

Introduction

The EOS Network Foundation (ENF) is a not-for-profit organization that coordinates financial and non-financial support to encourage the growth and development of the EOS Network. Composed of a core team that is responsible for day-to-day management and administrative operations, the ENF is overseen by a seven member EOS Foundation Advisory Board that serves as an oversight function to ensure external stakeholder accountability is present.

On August 25th, 2021, EOS Block Producers (BPs) signaled their support for the ENF by approving the creation of the eosio.grants account, re-activating the eosio.saving bucket with 2% inflation, and approving the transfer of ~3.4m EOS to eosio.grants.

From this endowment, the first three pillars of funding, Eden, Pomelo, and the Grant Framework emerged. A fourth pillar: EOS Network Ventures (ENV) has been discussed over the past eight months, was included in the ENF public road map since the first published quarterly report on January 25, 2022, and was explained in a video by Yves La Rose on March 3, 2022 (originally referred to as ENF Ventures). The concept of ENV was later discussed on several EOS Fireside Chats over the months that followed leading up to the MSIG (multi-signature) being proposed to the EOS Network.

On November 7th, 2022, a multi-signature proposal was introduced on-chain by ENF CEO Yves La Rose to create the eosio.fund account and issue 68,277,906.6221 EOS to that account, pending approval by at least 15 of 21 active EOS Block Producers. The memo included in that proposal read “ENV Fund”.

On November 9th, the ENF announced that it had initiated a proposal to launch a $100m ecosystem fund to be managed by EOS Network Ventures.

We have seen several significant developments in a short period of time, and naturally, there are many questions from the EOS community that deserve further consideration.

As the EOS ecosystem matures and grows more complex it becomes increasingly difficult to track all of the many different entities and ongoing developments. We created this FAQ to bring more clarity to the role of the newest proposed entity, EOS Network Ventures, the reason for the issuance of ~68m EOS, and to address the many questions voiced by the community.

Background

To explain the rationale behind the issuance of this particular number of EOS we must first make a brief review of these significant events in the history of EOS.

EOS launched with 5% yearly inflation, with 1% of inflation directed to the BPs, and 4% being directed to the eosio.saving account, as per the white paper.

In the history of EOS there have been two events where EOS that had been accruing in the eosio.saving account were retired, or “burned” using the [retire] action.

During the first such event, on May 7th, 2019, EOS BPs reached consensus to retire all of the tokens that had accumulated in the eosio.saving account up until that point, which amounted to 34,171,037.4625 EOS, valued at over $165 million at the time.

The inflation rate remained intact, however, and that account continued to accrue 80% of the newly issued (but still illiquid) EOS supply into the eosio.saving account.

On May 31st of 2019, a referendum was proposed “to change the EOS annual rate of inflation from 5% to 1%.”

“8 months have passed [sic] and there is still no defined use for this large quantity of EOS tokens that continues to flow into the eosio.saving account. This large quantity of accumulated tokens has now become excessive and if we continue to allow it to keep growing, it will eventually become an attack vector for the network.”

After several months of deliberation and near-unanimous support from token-holders who participated in the poll, on February 25th, 2020, EOS network validators reached consensus to call the [setinflation] action. This reduced the inflation rate of the network from 5% to the rate of 1% and eliminated the 80% of block rewards previously dedicated to the eosio.saving account, effectively eliminating the role of that account on the network.

Hours later, EOS BPs again reached consensus to retire the remaining 34,106,869.1596 EOS tokens, valued at nearly $140 million at the time, that were held in the eosio.saving account.

Rationale

After the EOS Network Foundation launched in August of 2021, the mechanism by which these previously retired EOS could be deployed to benefit the network has since come into existence.

The net effect of both EOS retire actions was the removal of 68,277,906.6221 EOS from the total supply. On November 12, 2022, the EOS BPs reached consensus on issuing ~68M tokens, effectively replacing the ones that were previously retired.

The ENF and EOS Block Producers were aware that a token issuance of this magnitude could be seen as controversial by some, so to solidify the fact that this was a one time event, and remain well below the original intention of token issuance on EOS, consensus was reached that the amount issued should not exceed what was previously retired.

The overlap of voting BPs from the 2019/2020 token “burns” and the 2022 token issuance is also noteworthy. Twelve of the BPs who signed for the recent issuance were also involved in at least one of the token burns.

Even with this 68m EOS issuance, the EOS Network is still well below the limits on inflation proposed in the whitepaper which called for a worker proposal system to be funded by 4% inflation from eosio.saving.

For additional perspective it is worth considering that without the previous intervention by BPs in retiring EOS on two occasions and calling [setinflation] to reduce network inflation from 5% to 1%, a continuously compounding 5% inflation on the initial 1B token supply from launch of the EOS network on June 6th, 2018 until now, 4.45 years of network operation, would have added an additional ~242.5M $EOS to the total supply.

FAQs

1. What is EOS Network Ventures?

EOS Network Ventures is a proposed venture capital fund whose mission is to attract capital investment and deploy that capital for the benefit of the EOS Network as a whole. Making strategic equity and token-based investments into tech startups across the Web3 space. This includes GameFi, the metaverse, eSports, NFTs, fintech Web3 businesses, and entrepreneurs building on the EOS public blockchain.

It is important to note that the ENV does not formally exist yet. The only step that has been taken is the formal signaling of a desire for this mechanism to exist via a multisig proposal. Any information provided regarding the ENV is speculative and represents the ENF’s understanding of what ecosystem leaders are advocating for as this new mechanism is formalized.

2. Why launch the ENV as an independent entity? Couldn’t the ENF take on these same functions?

The EOS Network Foundation and EOS Network Ventures will be independent entities with distinct but complementary mandates to serve the EOS Network.

The EOS Network Foundation is a non-profit with a mission to enable businesses, developers, and individuals to build on the EOS network. It is responsible for maintenance and development of the EOS software stack, representation of the network through informational materials, and distribution of grants for public goods within the ecosystem.

While all of these areas are important to the future growth of the network, they do not provide any mechanism to inject capital into the network and return on investment through for-profit initiatives. This will be the role of the ENV within the EOS ecosystem.

The ENV will complement the ENF’s efforts by serving as a separate, for-profit entity that is able to facilitate partnerships and attract external capital to invest in projects that benefit the EOS ecosystem, while generating a profit for the network.

3. How was ENV initially funded, and what account currently holds the ENV tokens?

On November 7th, 2022, a multi-signature proposal was introduced on-chain by ENF CEO Yves La Rose to create the eosio.fund account and issue 68,277,906.6221 EOS to that account, pending approval by at least 15 of 21 active EOS Block Producers. The memo included in that proposal read “ENV Fund”.

On November 9th, 2022, the proposal passed with a 15/21 consensus from the network’s block producers, signaling the network’s intention to enable this new funding mechanism, and the eosio.fund was created which holds the ~68m EOS tokens under a 4/7 multi-signature contract.

4. Who will be directing the ENV?

As noted earlier, the ENV does not currently exist. Specifics on who will be directing and working for the ENV cannot be provided as the entity has not yet been formalized. Signing the multisig that will fund the ENV was a prerequisite to hiring leadership for the ENV. Approval of the EFM fund has created the necessary conditions for operational logistics to begin moving forward.

With that noted, there are soft-commitments from notable professionals and other major funds in the space. Over the coming months these relationships will be formalized and publicly announced.

5. Who are the ENV’s decision makers?

ENV will have its own independent leadership who will be made public as soon as accepting positions to manage the fund. Any professionals with experience in this area should reach out to members of the EFM to explore potential involvement.

Similar to the previous questions, these details will become more clear once the ENV entity is in existence. Currently, any details are conceptual but they provide an idea that has the backing of the network and outline what our community is working towards creating and operationalizing.

It will operate like a traditional VC structure with a mandate for investments to leverage EOS. This is what ecosystem leaders that pushed forward the proposal will be advocating for.

6. What is the EOS Fund Management (EFM)? Who are the EFM multisig members, and why were they chosen?

The EOS Fund Management will be the custodian of a treasury acting as a Limited Partner (LP) in EOS Network Ventures. eosio.fund is the on-chain fund account and is administered by a number of industry leaders and trusted community members were chosen to be signers on the EFM multisig based on credible industry experience and trusted reputation within the EOS community.

The signing accounts are as follows:

- atticlabeosb: Attic Lab, the leading industry fintech experts behind Everstake. Everstake is the largest decentralized staking provider with 600,000+ users and $6.2 billion in staked assets.

- aus1genereos: GenerEOS, Australia’s leading blockchain infrastructure and decentralized application building agency. The team behind Scarce NFT Studio and GenPool, the first stake rewards platform on EOS with $59M+ EOS Staked

- big.one: Big.one Exchange, a global cryptocurrency exchange that provides a secure platform for trading blockchain assets.

- hashfineosio: Hashfin, a staking pool deeply involved in public chain governance and development.

- larosenonaka: Yves La Rose, CEO of the EOS Network Foundation, a force for positive global change, charting a coordinated future for the EOS Network through decentralization and community.

- msig1efmtony: Tony Tsao is an OG community member who has been involved with the EOS Network since its genesis, originally with the JEDA (Japan EOS Developer Association) block producer.

- winston1efm1 – Wen Huaqiang (Winston), ENF advisory board member, veteran developer, and initiator of CryptoKylin and BOScore.

7. Who are the General Partners (GP) and Limited Partners (LP) managing ENV?

The EOS Fund Management will be the custodian of the EOS treasury, acting as a LP in EOS Network Ventures. With that noted, the EFM will not be the only LP. Other GPs and LPs will join this initiative as the ENV is formalized.

The intention is for ENV to have other LPs bring external capital into the ecosystem fund as well. This would minimize the financial commitment from the EOS network and direct external capital into the ecosystem in a way that maximizes impact.

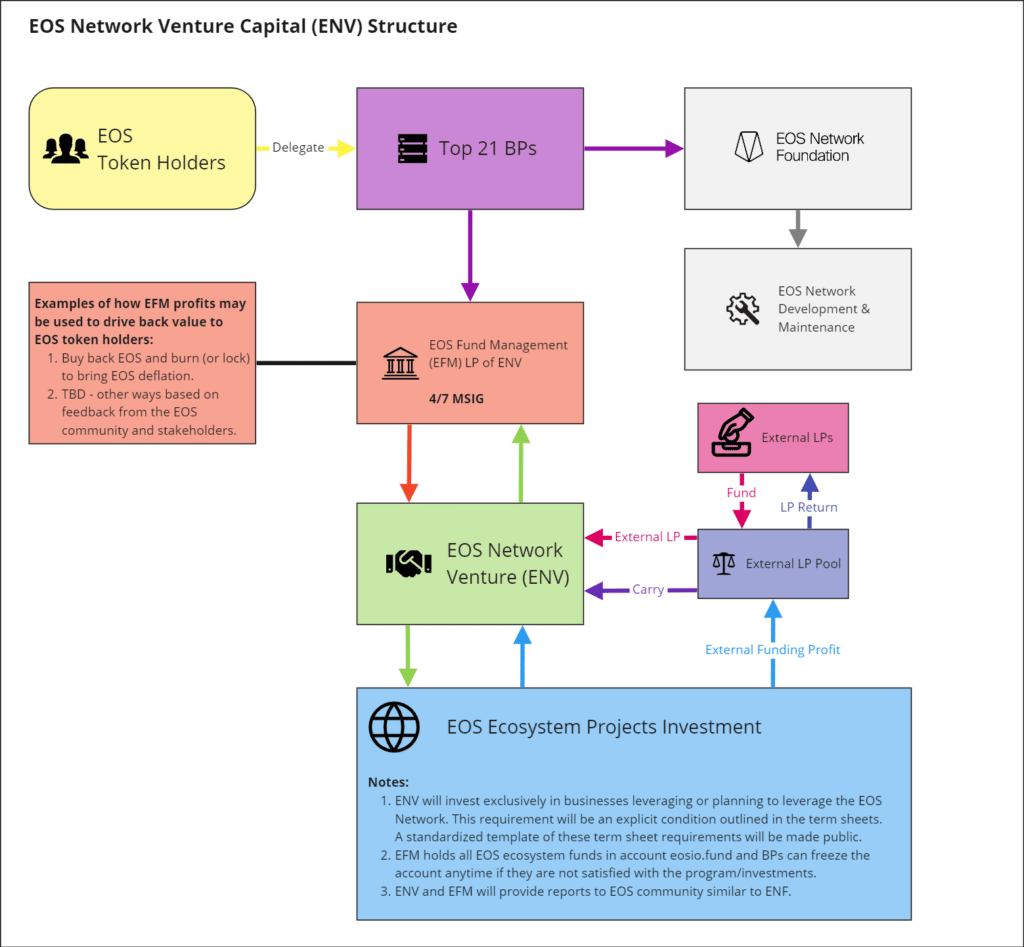

8. What is the structure and operating model of the ENV and related bodies in the EOS ecosystem?

The chart below provides a high level overview of the various entities within the EOS ecosystem and an understanding of how ENV may be structured. Also included is clarity on how the network reaches consensus to signal support for these functions.

9. Where will the ENV be incorporated?

The ENV is an independent organization and will be making its own decision on where and how it will be incorporated. The process for incorporation has only begun with the approval of the MSIG.

10. What was the communication with the community in planning this initiative?

The concept of a venture initiative has been discussed with the community on a number of occasions over the past year. Initially titled ENF Ventures, the concept was first released in January on the roadmap for Q4 of 2022. Potential funding sources were also discussed on page 61 of the Yield+ Blue Paper.

The idea evolved over time and eventually became EOS Network Ventures. This had also been discussed with the community over a number of EOS Fireside Chats in recent months. However, this information couldn’t be formalized without the network coming to consensus and signaling its support through the multisig approval.

11. What is the vision for how the ENV will impact the EOS community?

The intention of those forming the EFM is that it may become a minority LP in the ENV fund, with most capital coming in externally. Profits earned by the EFM will go back to initiatives that benefit the EOS community. This could include initiatives such as buy back and burn or profits being allocated to future investments. Other economic incentives will be discussed with the EOS community before any final decisions are made.

EOS Network Ventures’ primary mission is to attract and grow value for the EOS ecosystem. Projects that don’t leverage EOS will not be considered, including those leveraging Antelope technology outside of EOS.

12. How will the ENV be held accountable to token holders?

While the ENF does not have a direct impact on the decisions made by the ENV, we are advocating for a similar level of transparency to our own operations, within legal constraints of the ENF’s structure.

In addition to transparency measures such as quarterly reports, the EOS Fund Management will serve as a check and balance for the ENV.

Additional Resources:

For an in-depth discussion and live AMA on EOS Network Ventures with Yves La Rose and other members of the EOS community, please refer to the EOS Fireside Chat from November 16th:

EOS Network

The EOS Network is a 3rd generation blockchain platform powered by the EOS VM, a low-latency, highly performant, and extensible WebAssembly engine for deterministic execution of near feeless transactions; purpose-built for enabling optimal web3 user and developer experiences. EOS is the flagship blockchain and financial center of the Antelope protocol, serving as the driving force behind multi-chain collaboration and public goods funding for tools and infrastructure through the EOS Network Foundation.

EOS Network Foundation

The EOS Network Foundation is a not-for-profit organization that coordinates financial and non-financial support to encourage the growth and development of the EOS Network. The ENF is the hub of the EOS Network, harnessing the power of decentralization as a force for positive global change to chart a coordinated future for EOS.