New Era for EOS: X Space Recap

The X Space began at 2000 UTC on June 12 2024, hosted by Stéphane Bisson who facilitated the discussion between Yves La Rose, CEO of the EOS Network Foundation, Aaron Cox, Chief Brain of Greymass, and Nathan James, Director of Developer Relations at the EOS Network Foundation. They discussed the newly approved tokenomics, what lies ahead for EOS, and even reminisced on some EOS history.

Some highlights from the X Space included:

- Formation of the Tokenomics Proposal: Developed through extensive EOS community feedback and data analysis since the inception of the EOS Network Foundation.

- Reduction of Overall EOS Supply: The total supply of EOS has been cut from 10 billion to 2.1 billion, effectively burning 80% of the anticipated future token supply.

- Infrastructure Support through Middleware Allocation: 15 million EOS has been dedicated to Middleware to enhance infrastructure development. The first 5 million have been entrusted to Greymass, who are leading this initiative, with a focus on improving the onboarding experience for new users.

- REX 2.0 Staking Rewards: Effective July 8th, staking rewards will be distributed from a network allocation, offering attractive APY to boost on-chain TVL. Accompanying technical updates include removing the vote proxy requirement and extending the staking period from 4 to 21 days.

- Allocation of 350M EOS to RAM: Primarily for market-making efforts between RAM and EOS, this allocation may also support the creation of additional token pairs, thereby enhancing liquidity and accessibility.

- Redirection of System Fees to Block Producers: With the REX 2.0 upgrade, fees from PowerUp, RAM trading, and Name Auctions are redirected to top block producers, aligning incentives and ensuring sustainable funding for network maintenance and development.

Tokenomics Proposal

“The idea with the tokenomics is to simply rip the bandaid and to launch anew, EOS 2.0 so to speak.”

Following Steph’s introductions, Yves took the stage to elaborate on the genesis of the new tokenomics proposal for EOS. He explained that the proposal emerged from a thorough review of the incremental changes made in EOS over recent years and an assessment of practices within other blockchain ecosystems. The aim was to integrate lessons learned and align EOS more closely with industry best practices. This involved gathering extensive feedback from a broad spectrum of EOS community members including stakeholders, block producers, token holders, and developers.

Yves emphasized that the proposal was designed to rectify previous shortcomings and position EOS alongside other successful blockchain ecosystems. It represented a significant shift from the past, moving beyond incremental updates to a comprehensive overhaul, which he metaphorically described as ripping off the bandaid to launch a new version of EOS—EOS 2.0. Key updates in the tokenomics included revising token issuance mechanisms and introducing new funding buckets dedicated to staking rewards, middleware development, and initiatives for RAM market-making.

Impacts On EOS Overall Supply

After Yves introduced the origins of the tokenomics proposal, Steph asked about its impact on the overall supply of EOS. Yves explained that under the original EOS code, there was a token supply cap of 10 billion, which would have taken approximately 72 years to reach with the previous inflation rate. The new tokenomics approach has significantly altered this by retiring or burning about 80% of the future token supply, thus setting a new maximum supply limit of 2.1 billion tokens.

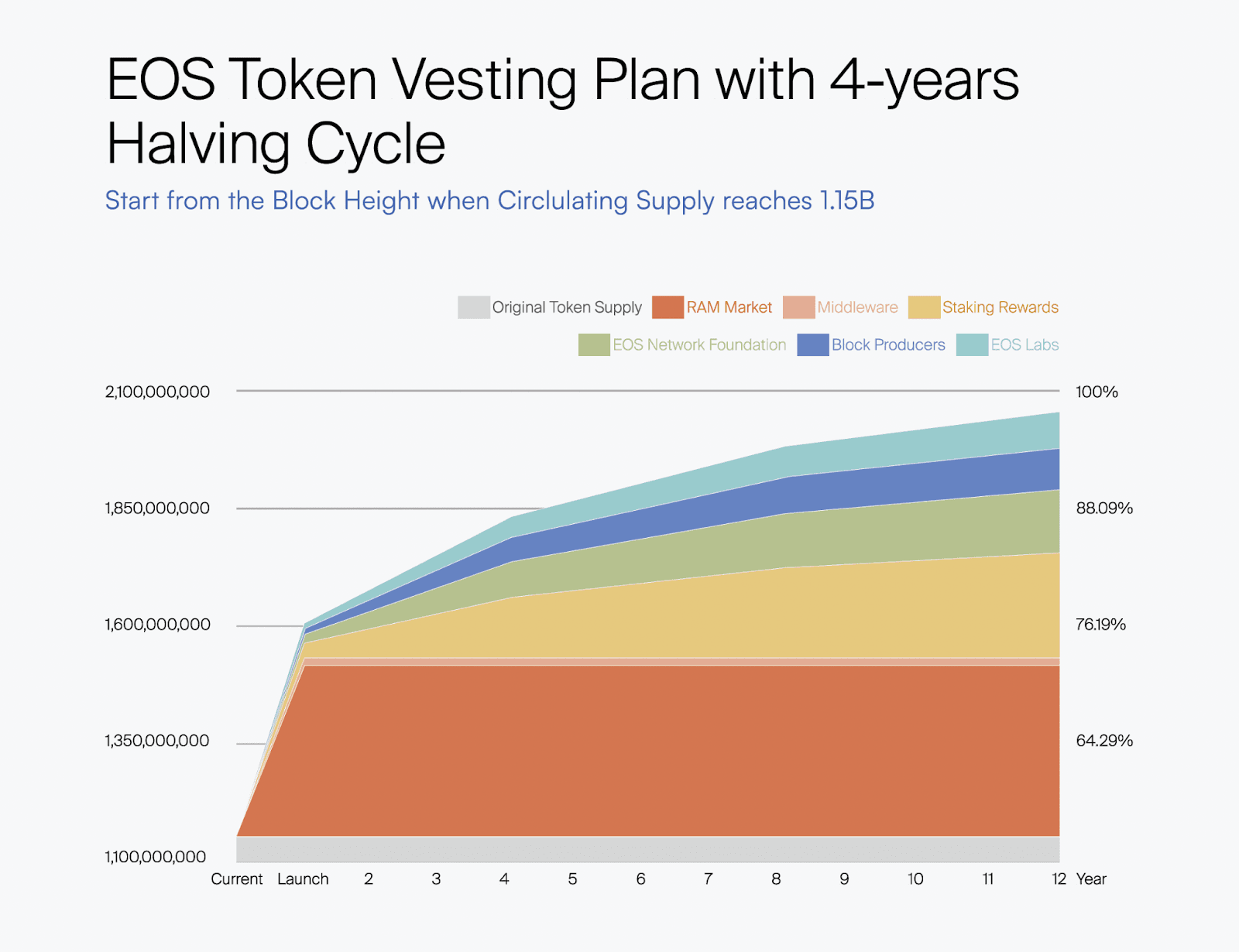

Concurrently, tokens were issued to reach this new cap of 2.1 billion. Out of these, 365 million tokens were made immediately liquid. Specifically, 350 million of these liquid tokens were allocated to the RAM bucket and the remaining 15 million to the Middleware bucket. The rest of the supply, approximately 600 million tokens, is set to be issued gradually over the next 24 years. The issuance rates will decrease in a manner similar to Bitcoin’s halving cycle, occurring every four years. This adjustment aims to minimize inflation effects over time and reduce the total supply by 80%

A Diverse Funding Framework

Steph shifted the conversation towards the new tokenomics funding buckets and their significance. Yves outlined the updated tokenomics of EOS, which involve the full minting of the 2.1 billion token supply. Some tokens are already circulating, while others are vested and set to be released gradually over the next 24 years through six halvings, introducing a treasury-like system that was previously absent in EOS.

Yves pointed out that the funding for existing entities like the EOS Network Foundation (ENF) bucket and the Labs bucket remains approximately the same under the new tokenomics, maintaining stability.

The key change in the new system is the strategic reduction in issuance, which will halve every four years at each of the six planned halvings. This is designed to align incentives for entities to effectively deploy and utilize their tokens, fostering sustainable growth within the EOS ecosystem.

Aligning Block Producer Incentives with Network Fees

Yves then detailed the changes to block producer rewards. With the introduction of REX (Resource Exchange) 2.0, network fees, previously directed to REX, will begin flowing to the top 21 active block producers (BPs). This provides incentives for block producers to see more transactions on the chain and to maintain and improve network infrastructure. This change, scheduled for July 8th with the upgrade to REX 2.0, will see these fees paid in addition to the regular block producer pay.

Yves explained that the redirection of network fees from REX to the top block producers aligns with the need for more performant infrastructure as EOS activities increase. Previously, as network activity increased, block producers faced higher operational costs without corresponding compensation, leading to misaligned incentives. This change ensures that block producers are adequately incentivized to support increased transactions and network utilization.

He noted that block producer rewards, which were previously perpetual at a rate of 1% inflation per year, will eventually be phased out. In about eight years, the block producer rewards from the current bucket will no longer provide meaningful compensation due to the halving of issuance rates every four years. The transition to funding from network fees is essential to sustain block producer incentives in the long term, marking a significant shift in how EOS aligns and motivates its key network participants.

REX 2.0 Staking Rewards Overview

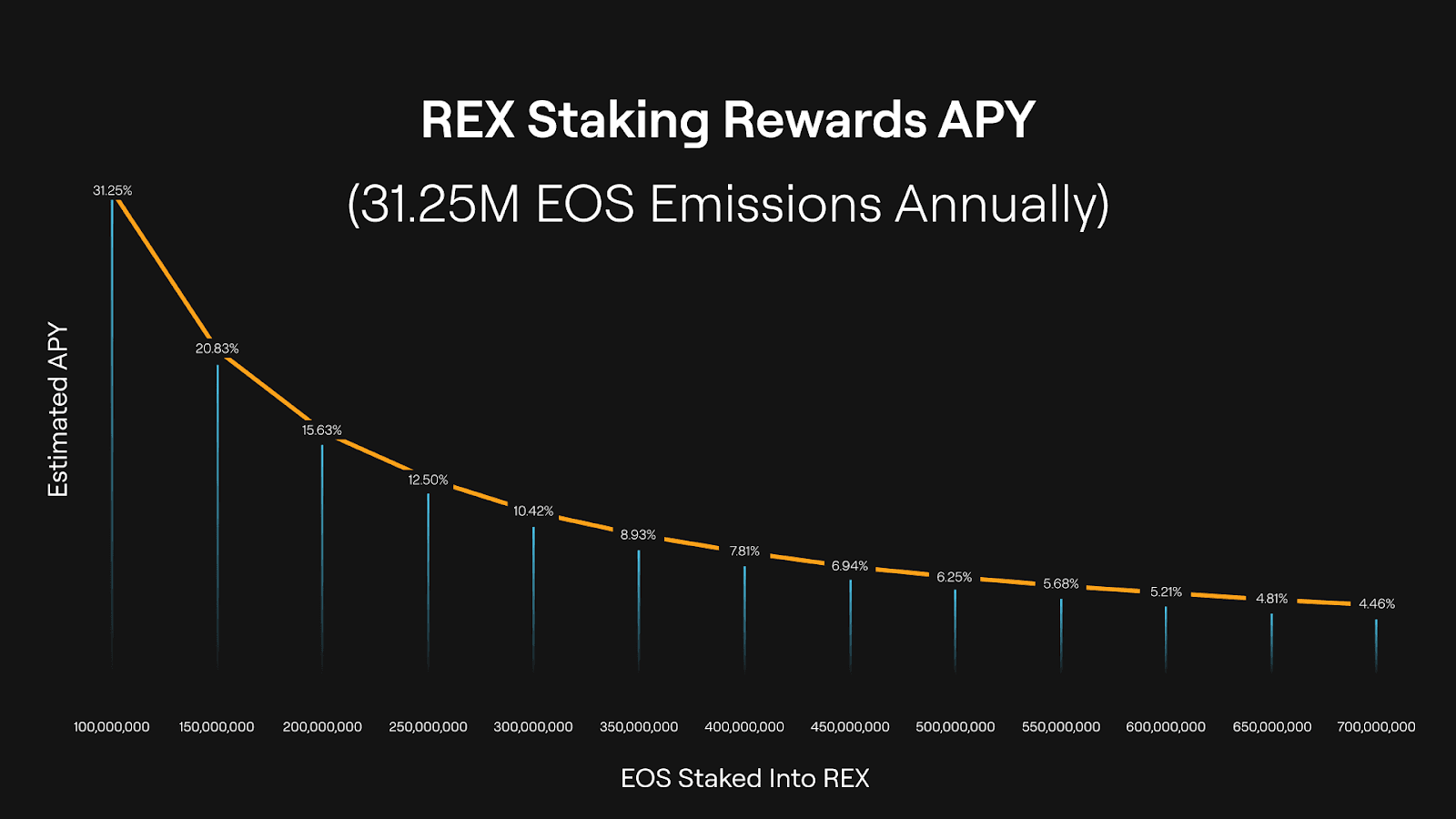

Yves detailed the new allocations for REX 2.0 staking rewards, totaling approximately 267 million EOS, with an initial annual issuance of 31.25 million EOS for the next four years. The expected annual percentage yield (APY) is designed to adjust based on the EOS staked in the pool, estimated at about 10.42% with the current staking of around 300 million EOS. However, at the time of the event, only about 50 million EOS are actually staked. This low level of participation, compared to the potential staking capacity, suggests significant room for growth in staking participation, especially as the high APY offers considerable returns for those early to stake.

The staking function and the allocated tokens will go live on July 8th, 2024, when funds from the eosio.rewards account begin flowing into the REX staking pool. Concurrently, significant changes will be implemented, including extending the staking unlock, or maturation period, from 4 to 21 days and eliminating the voting proxy requirement. These updates aim to promote longer staking durations and provide competitive returns, potentially increasing the Total Value Locked (TVL) and encouraging more EOS token holders to engage.

On-Chain Status Update

The overall implementation of the new tokenomics, including the creation and updating of allocation buckets and the issuance of EOS, was completed as planned on June 1st. Currently, the only components yet to be finalized are related to the staking and block producer rewards, with all systems set to be fully operational by July 8th. Until then, rewards from staking in REX will be generated by network fees. The timeline for these final adjustments is dependent on an audit, scheduled to start on June 15th, ensuring that barring any issues, the new staking functionalities will be accessible as expected.

RAM Allocation

Yves then discusses the new RAM bucket, which includes 350M EOS designated primarily for market-making efforts for RAM and EOS. Historically, the absence of a treasury hindered market making efforts due to the sheer quantity of tokens required. While market making efforts will focus primarily on RAM, there will likely be EOS market making in order to increase the liquidity depth of EOS in areas where it may not be prominent.

Yves illustrates this with an example: placing an EOS and RAM pair on Uniswap would have little effect of expanding our market reach if no other pairs existed to link EOS or RAM to other major cryptocurrencies like Bitcoin or Ethereum. This limitation would isolate potential new holders who do not have EOS or RAM despite having other tradeable cryptocurrencies. This allocation can potentially be utilized to create additional token pairs, further increasing liquidity depth and accessibility of EOS and RAM.

Middleware Allocation

“This bucket is designed to create the essential connective tissue—middleware—that links users, token holders, the software, and the platform.” —Aaron Cox, Greymass.

The Middleware bucket, which has been allocated 15M EOS, was the final new allocation discussed. Yves transitioned the conversation over to Aaron to discuss the Middleware allocation as Greymass has recently received 5M of this allocation. Aaron began by describing Middleware as the connective tissue between the users, the software and the platform side of the software. Wharf was provided as one example of middleware, which is an SDK that was developed for EOS and Antelope to help developers more easily build applications and connect their users to the blockchain. The middleware funding aims to improve user experience (UX) and user interface (UI) by bridging gaps between users, applications, and the blockchain platform, thereby fostering easier development and broader adoption within the EOS ecosystem. Overall, Greymass aims to make EOS easier for users to use and for the developers to build on.

Middleware Priorities

Aaron shared that the primary focus is currently to improve the onboarding experience for new users on EOS and other Antelope chains. This involves addressing initial hurdles such as setting up wallets, handling complex backup procedures, and streamlining resource management to remove barriers for newcomers. Simplifying account creation, ensuring wallet compatibility, and abstracting network resources are key priorities. Efforts are rooted in extensive research and planning that began with initiatives like the Blue Papers nearly three years ago, which birthed ideas like WharfKit SDK for enhancing blockchain usability. Many concepts from that time remain relevant today, highlighting ongoing efforts to advance and expand the technology.

Aaron discussed revisiting the idea of integrating Metamask with EOS and other Antelope chains through Metamask’s Snap plugins. Originally this was an option considered during the blue paper phase but the idea was dismissed as the technology was not ready. Interest was recently reignited by suggestions from ENF and Labs. Initial prototypes show promise in enabling Metamask to import EOS accounts and sign transactions. Pending audits and improvements, a Metamask Snap for EOS could soon be released, enhancing user convenience and integrating with Wharf for broader application compatibility. Challenges remain, such as integrating existing accounts and ensuring security protocols align with Metamask’s standards, but progress is optimistic.

Enhancing RAM Utility on EOS

Having discussed the new tokenomics in detail, Steph then questioned how the new tokenomics are likely to impact RAM. Yves first described RAM as a combination of DePin and RWA; it is a powerful and valuable physical resource that facilitates the reading and writing of data to the blockchain. He details how RAM is a decentralized physical infrastructure, as every node on a network, block producers in particular, have to provide the amount of RAM that is currently being consumed.

Yves described the history of the RAM market. RAM was initially a fixed resource at 64GB and the price of RAM skyrocketed immediately. This was mostly due to speculative demand from smart contract deployment needs. Based on consensus from Block One and the block producers, it was decided to increase the supply of RAM at the rate of one kilobit per block. This decision essentially killed the entire financial market around RAM while lowering costs to nearly zero for operations like account creation and smart contract deployment. The recent stabilization of RAM supply at 390GB has revitalized the RAM market along with increased blockchain activities including inscriptions and scaling solutions.

Nathan and Yves discussed the evolving economics of RAM, highlighting its role in incentivizing efficient blockchain operations and attracting diverse stakeholders to EOS. They anticipate further developments with upcoming changes in EOS tokenomics, with the goal of fostering a robust and sustainable blockchain economy.

Some of the use cases of RAM discussed are detailed below:

exSat

exSat is a bitcoin scaling solution which will be built on and powered, in large part, by EOS. It will be writing all UTXO data to EOS RAM, thereby consuming even more RAM. The projections for this project right now are a little over 100 GB of RAM that will need to be consumed.

Droplets

An open source smart contract that utilizes EOS RAM to generate a unique non-fungible ordinal object natively in EOS. You can create, transfer and destroy them. Participation in Droplets is entirely voluntary and can be utilized for token distributions amongst other use cases.

SCRAP

SCRAP is a token currently being mined through the use of Droplets. This token is one of the tokens for the game under development by the Greymass team, Shipload. The utilization of Droplets for token mining is similar to how inscriptions have been used for token distributions on Ethereum.

EOS History

The discussion around RAM innovation led to the group reflecting on the legacy of the EIDOS project: a learning opportunity that led to the evolution of the EOS blockchain. EIDOS introduced a valuable use case to the EOS ecosystem, which was CPU mining. It also contributed significantly to EOS’s transaction records. The downsides of EIDOS was that users were allowed to exploit the system without significant loss, which led to unsustainable costs associated with data consumption and indexing, increased network usage and network disruptions. This paved the way for EOS’s shift from staking to a gas model with PowerUp.

The Path Forward for EOS

The recent X Space event provided a comprehensive overview of the significant updates and changes to EOS tokenomics, shedding light on the new staking rewards, RAM allocation, middleware development, and the realignment of block producer incentives. These discussions underscored the collaborative efforts within the EOS community to foster sustainable growth and enhance the functionality of the EOS ecosystem.

As EOS transitions into this new era, the community’s engagement and feedback will be crucial in navigating the path forward. For those who missed the live event, the full recording of the X Space discussion is available for listening. We encourage everyone to watch it to gain a deeper understanding of these significant changes and their implications for the future of EOS.

Looking ahead, stay tuned for our next X Space event, where we will continue to explore and discuss the latest developments and innovations within the EOS ecosystem. Your participation will be invaluable as we collectively shape the future of EOS. We look forward to your presence and contributions in the upcoming sessions!

EOS Network

The EOS Network is a 3rd generation blockchain platform powered by the EOS VM, a low-latency, highly performant, and extensible WebAssembly engine for deterministic execution of near feeless transactions; purpose-built for enabling optimal Web3 user and developer experiences. EOS is the flagship blockchain and financial center of the Antelope framework, serving as the driving force behind multi-chain collaboration and public goods funding for tools and infrastructure through the EOS Network Foundation (ENF).

EOS EVM

The EOS EVM is an emulation of the Ethereum EVM, housed within an EOS smart contract. It offers feature parity to other EVMs in the space but with unmatched speed, performance and compatibility. EOS EVM connects the EOS ecosystem to the Ethereum ecosystem by allowing developers to deploy a wide array of Solidity-based digital assets and innovative dApps on EOS. Developers can use EOS EVM to take advantage of Ethereum’s battle-tested open source code, tooling, libraries and SDKs, while leveraging the superior performance of EOS.

EOS Network Foundation

The EOS Network Foundation (ENF) was forged through a vision for a prosperous and decentralized future. Through our key stakeholder engagement, community programs, ecosystem funding, and support of an open technology ecosystem, the ENF is transforming Web3. Founded in 2021, the ENF is the hub for EOS Network, a leading open source platform with a suite of stable frameworks, tools, and libraries for blockchain deployments. Together, we are bringing innovations that our community builds and are committed to a stronger future for all.