Yield+ is designed to build economic activity on EOS through incentivizing DeFi dApps that increase TVL and generate yield.

The program turned 5 months old starting the new year and was recapitalised with a further 300,000 EOS due to the success of this program. This month we witnessed the historic public launch of IBC across the Antelope networks which will enable much greater liquidity into the network.

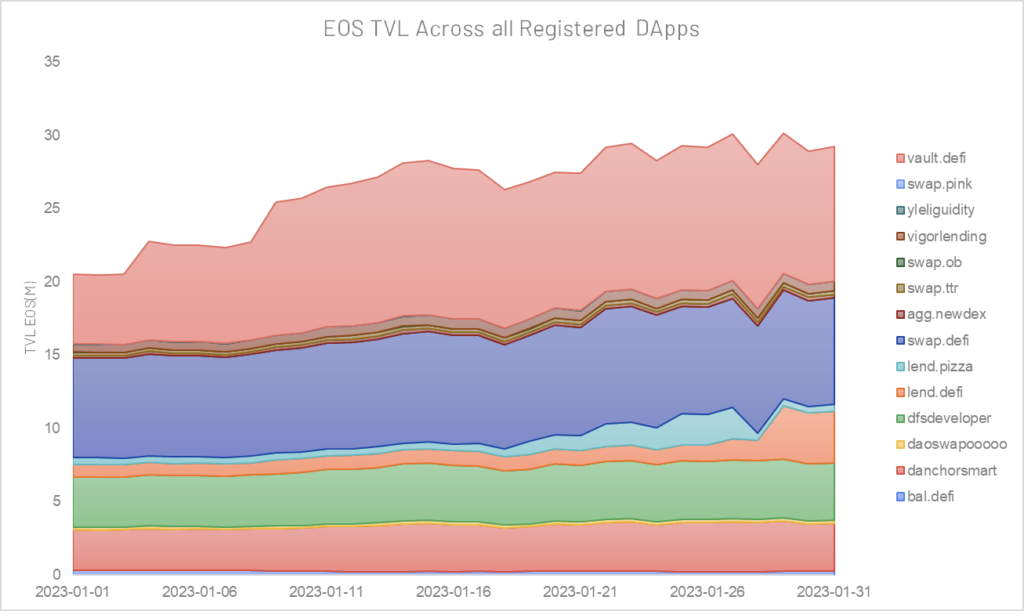

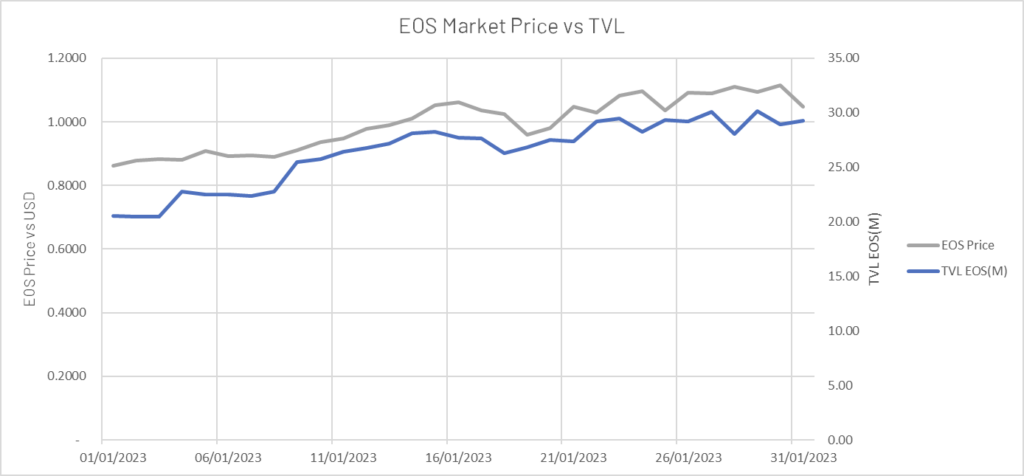

EOS TVL in the program increased by just under 43% in local terms, and with the buoyant markets created a 73% increase in US Dollar TVL to $35 Million across 14 dApps.

Total Value Locked (TVL)

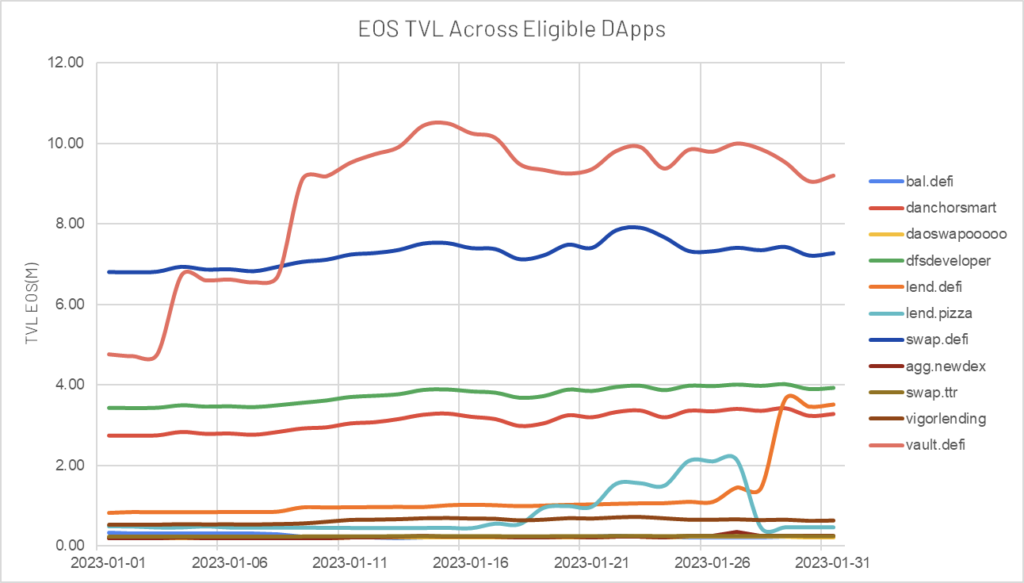

The current program allows for EOS and USDT to be counted as TVL for reward eligibility.

There are 4 tiers of eligibility for dApps with minimum TVL of EOS 200K, 750K, 1.5M and 3M respectively.

Top 5 dApps Change in TVL

| EOS (M) (t-1) | EOS (M) (t) | Δ | Δ EOS | Δ USD | |

| vault.defi | 4.76 | 9.20 | 93% | 4.44 | 5.39 |

| swap.defi | 6.80 | 7.27 | 7% | 0.47 | 0.57 |

| dfsdeveloper | 3.43 | 3.93 | 15% | 0.50 | 0.60 |

| lend.defi | 0.82 | 3.51 | 330% | 2.70 | 3.27 |

| danchorsmart | 2.74 | 3.28 | 19% | 0.53 | 0.65 |

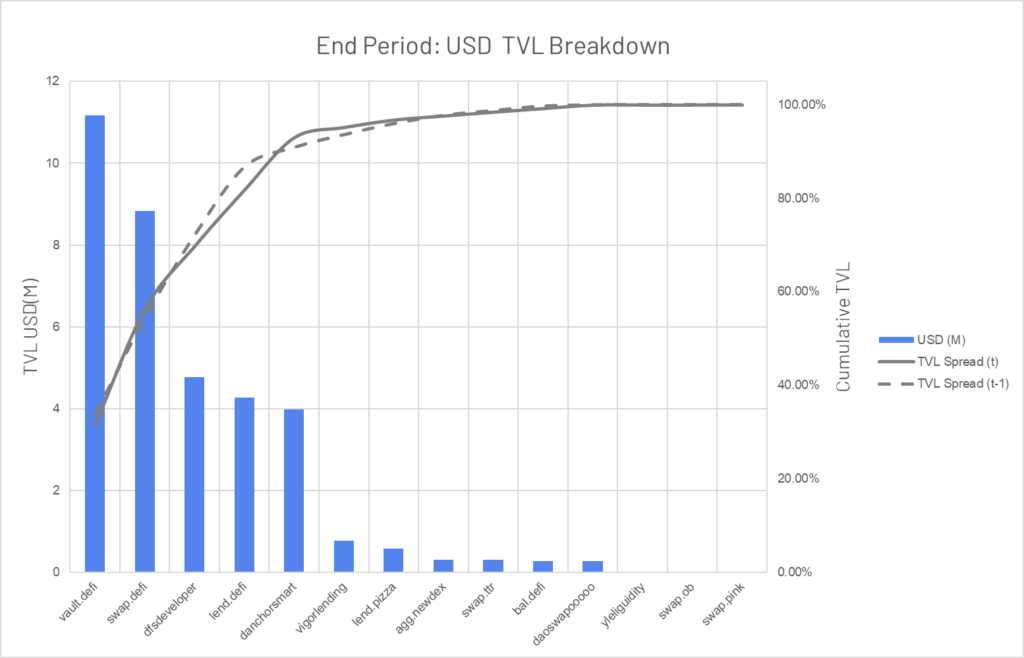

Cumulative TVL

The spread of TVL across dApps is just starting to broaden as we would expect in this phase.

Yield+ Treasury Account

The Treasury was topped up with 300,000 EOS at the end of the month to extend the program for 2023.

| Starting Balance | 91,314 |

| Allocated | 91,094 |

| Funding | 300,000 |

| Unclaimed | 4,893 |

| End Balance | 304,673 |

| Net of Liabilities | 299,780 |

Unclaimed rewards are generally not significant.

| Protocol | Unclaimed Rewards |

| lend.pizza | 4757.353 |

| daoswapooooo | 109.8391 |

| agg.newdex | 14.8448 |

| dfsdeveloper | 10.4669 |

| swap.ttr | 0.2151 |

| Total | 4892.719 |

Performance Metrics

The original Yield+ Blue Paper highlighted three core stages of the transition of a Layer 1 chain’s value proposition from speculation to ecosystem driven.

EOS remains in the first of these stages, ‘Green Field’, where Market Cap exists without significant TVL. In this stage, the Yield+ reward mechanism primarily aims to drive adoption through the TVL to Market Cap ratio, whilst the other factors are less significant.

As a brief reminder, the paper considers a formula to calculate total rewards is calculated via three factors

- TVL to Market Cap ratio

- Absolute TVL (scaled [0.1])

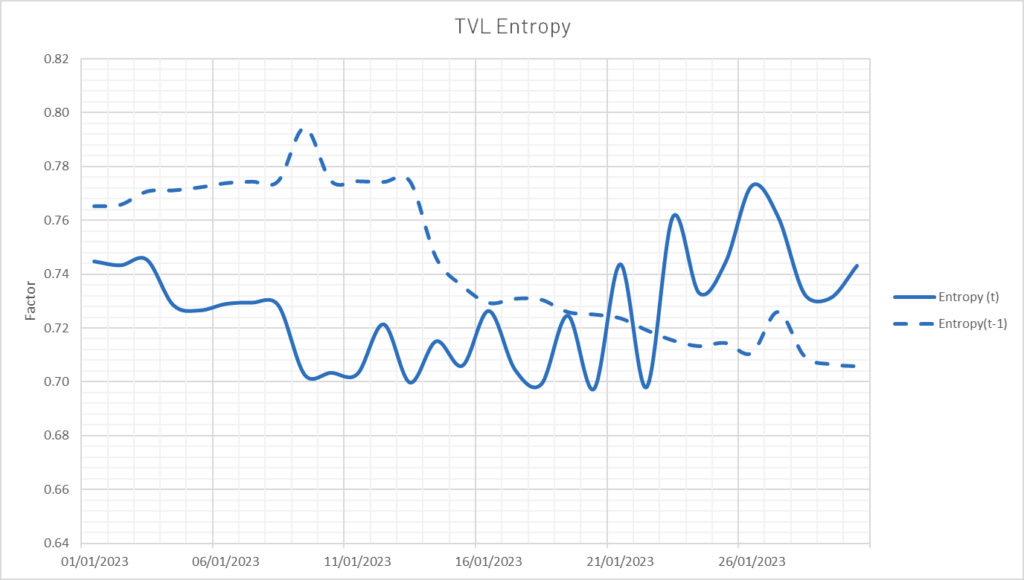

- Distribution of TVL – Entropy (scaled [0.1])

The three different factors that will ultimately determine long term rewards play different roles in driving this progress. Absolute TVL does not play a role at this point and drops out the calculations.

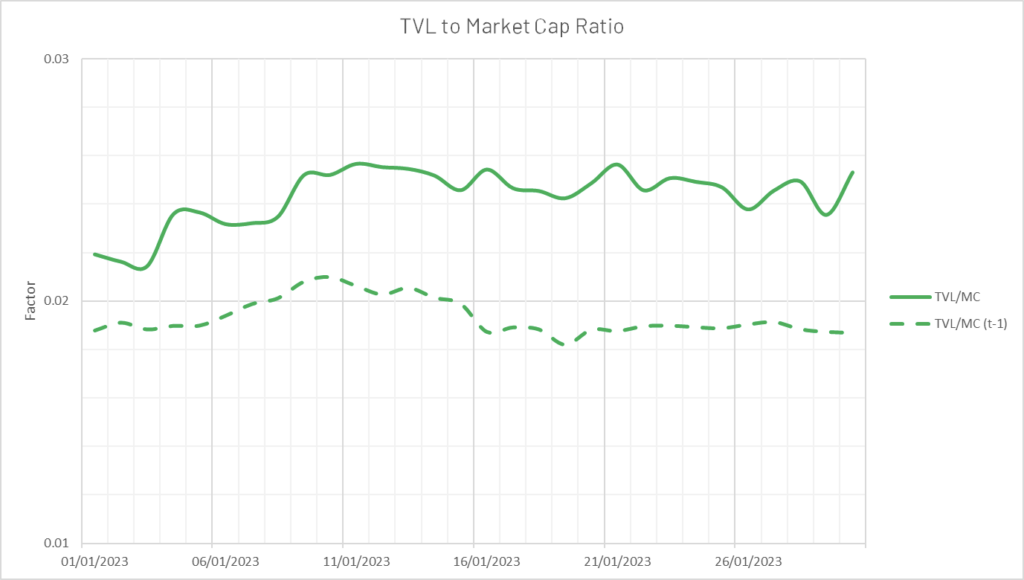

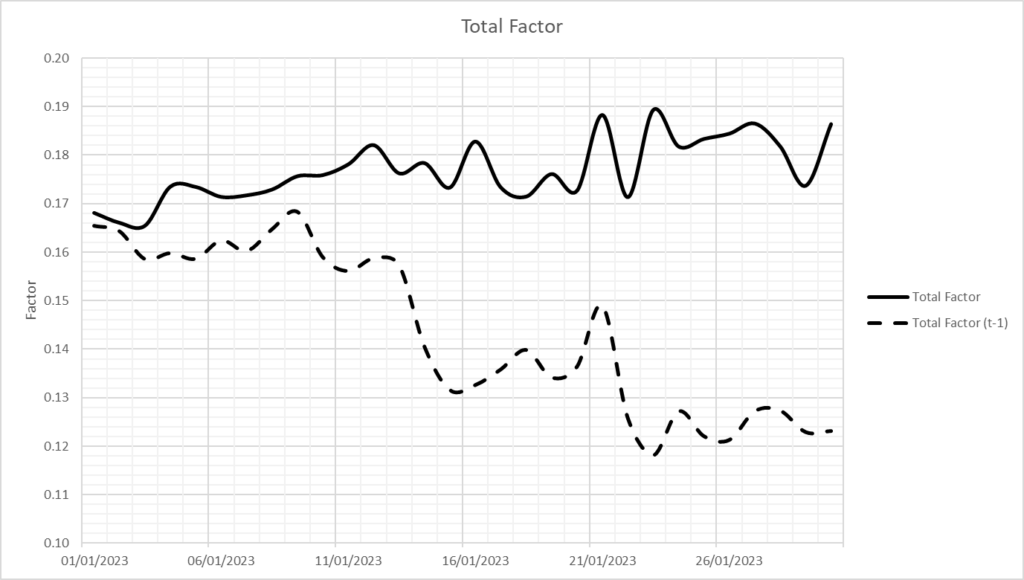

We display the trends of the two other components, Entropy and TVL to Market Cap Ratio below and the overall Factor that we observe to test the efficacy of the programme.

Entropy remains in the 0.70 to 0.75 range keeping a healthy balance of dApps.

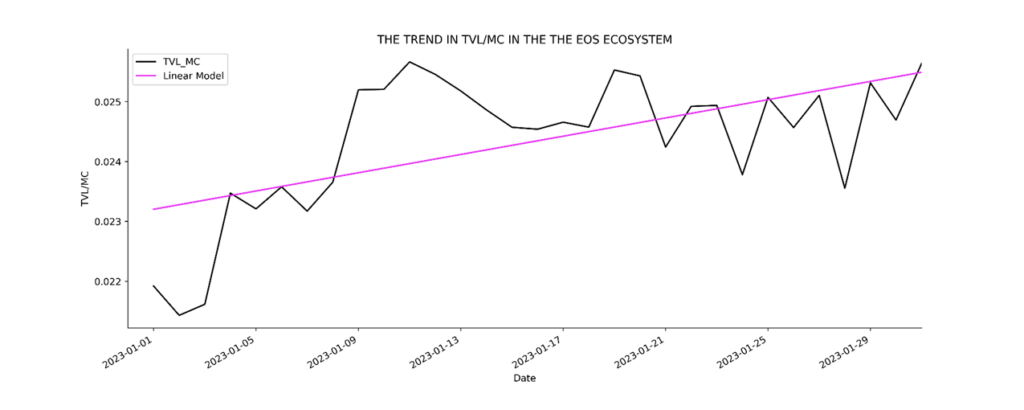

The key TVL to Market Cap ratio has increased by 15% this month and the combined effects on the total factor are seen below.

The correlation this month between local TVL and Market Price increased significantly to 0.91compounding the US Dollar TVL effect on the network.

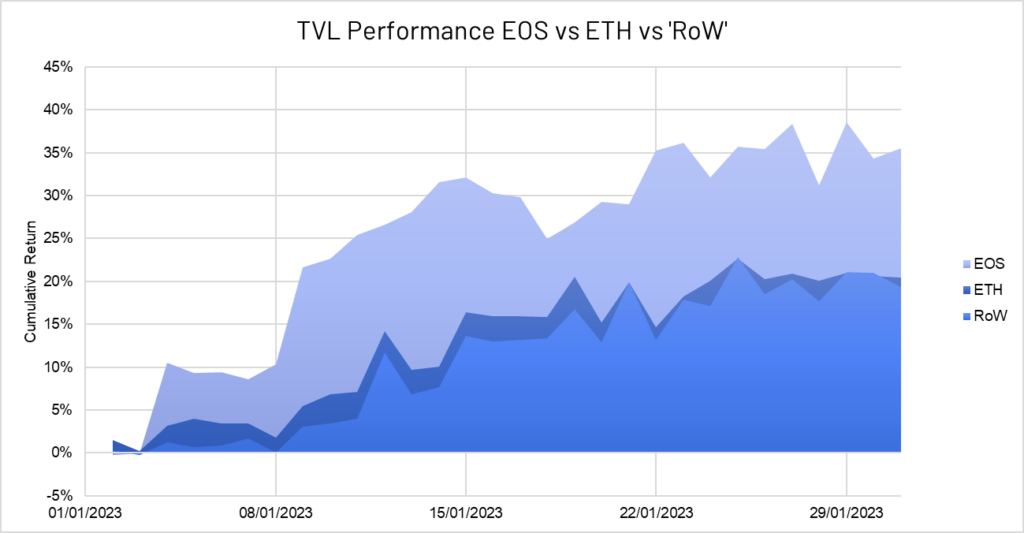

Wider Market

Below we have plotted TVL performance in EOS against Ethereum, and then a basket of other chains ‘RoW’ comprising Binance Smart Chain, Tron, Artbitrum, Polygon, Avalanche, Optimism, Fantom and Solana.

Although EOS still ranks outside the top 20 chains when it comes to absolute TVL, its specific TVL growth as a result of the Yield+ program is evidenced in the outperformance below.

The data this month confirms the same conclusions reached in previous reports and so recommendations remain similar. The program sees steady uptake and steady growth in TVL against market cap. TVL in the EOS ecosystem remains strongly idiosyncratic.

Recommendations

Since this is still early in the Yield+ program, the dataset does not allow us to draw hard and fast conclusions as to its effectiveness. The adoption trend has started to polarise in Crypto generally as ‘Real world’ businesses are looking to leverage Web3 technology whilst crypto-native entities are continuing to die off. EOS from a technology perspective is a prime beneficiary of this flow and once this commences, we will see TVL convert into economic activity for the network.

Report presented by 0rigin.one

EOS Network

The EOS Network is a 3rd generation blockchain platform powered by the EOS VM, a low-latency, highly performant, and extensible WebAssembly engine for deterministic execution of near feeless transactions; purpose-built for enabling optimal Web3 user and developer experiences. EOS is the flagship blockchain and financial center of the Antelope framework, serving as the driving force behind multi-chain collaboration and public goods funding for tools and infrastructure through the EOS Network Foundation (ENF).

EOS Network Foundation

The EOS Network Foundation (ENF) was forged through a vision for a prosperous and decentralized future. Through our key stakeholder engagement, community programs, ecosystem funding, and support of an open technology ecosystem, the ENF is transforming Web3. Founded in 2021, the ENF is the hub for EOS Network, a leading open source platform with a suite of stable frameworks, tools, and libraries for blockchain deployments. Together, we are bringing innovations that our community builds and are committed to a stronger future for all.